Understanding Interest Rates and Fees

Interest rates are subject to loan dynamics, inflation, policies, and more

Poor financial decisions can detract from your financial goals and drive you into problems like bad debt. By understanding interest and its impact on different financial products, you can avoid these pitfalls and set yourself up for financial success.

What Is Interest?

Interest is an additional amount of money an individual incurs or earns above the principal amount when they borrow or save money, respectively.

Paying Interest: When banks and lenders loan away their money, they’re unable to use it during the entire loan period. The borrower, on the other hand, will use this money to pursue their financial goals. Therefore, interest is the cost the borrower incurs for using the lender’s money.

Earning interest: Similarly, when an individual deposits money in interest-bearing savings accounts or buys government bonds, they’re lending money to a financial institution or the government. As a reward, the individual receives an interest.

Apart from not being able to use their money at the moment, lenders also charge interest to borrowers to protect themselves from risks like future inflation or untimely repayments by the borrowers.

Understanding Key Interest Terminologies

Principal: the actual amount of money borrowed or deposited without the interest

Interest rate: this is interest expressed as a percentage of the principal amount

Types of Interest Rates

Simple Interest

This is interest applied only to the principal amount of the loan borrowed.

Example: Suppose someone borrows a loan of $10,000 to be repaid after three years, with an annual interest of 5%. At the end of the loan term, the person owes:

Simple interest = Principal amount * Annual interest rate (in decimal) * Time period (in years)

= 10,000*0.05*3 = $1,500

Total amount owed = Principal + Interest = 10,000 + 1,500 = $11,500

Simple interest can be more favorable to borrowers and less beneficial to savers.

Compound interest

This is a cumulative form of interest. Interest is not only applied to the principal amount but also to the interest previously accumulated.

Using the same example above, at the end of the three years, one will owe:

A = P (1 + r/n)nt = 10,000 (1+ 0.05/1)3 = $11,576.25

A= compounded amount

P= principal amount

r = interest rate

n = number of times interest was compounded per year

nt = time in years

This interest can be compounded monthly, quarterly, semi-annually, or annually. The higher the frequency, the higher the compounded amount. Therefore, compound interest can be very costly for borrowers, especially on longer, larger loans. For savers, it can be a great wealth-building strategy. In the words of Albert Einstein:

“Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t…pays it."

Interest can also be classified as:

Nominal interest rate: This rate disregards the effects of inflation or compounding, therefore not the effective interest rate.

Real interest rate: The nominal interest rate adjusted to account for inflation

Annual percentage rate (APR): The total interest a borrower owes in a year, expressed as a percentage. It comprises interest plus any extra charges by the lender. Loan borrowers tend to compare this value among different lenders to find the best possible offer because while a loan’s interest can be low, its APR can be a deal breaker. Loan lenders are therefore expected to reveal this value to borrowers.

Fixed interest rate: Stays constant throughout the entire loan term.

Variable interest rate: Increases or decreases annually depending on the economic climate and other factors.

Factors Influencing Interest Rates When Borrowing Loans

Loan Dynamics

Loan Type

Each loan type has a different interest rate structure. Unsecured loans like credit cards, personal loans, and payday loans tend to attract high interest rates because if a borrower fails to repay the loan, the lender will incur a significant loss.

On the other hand, interest rates tend to be low for secured loans like mortgage and car loans. Should the borrower fail to pay, the lender can take the property and resell it to recover their money. However, these rates can still be high depending on the property’s age and condition.

The loan lender: Interest rates can be steep with some lenders. When considering a quick cash loan or any other loan, it's important to compare lenders to secure good loan terms. Some key considerations include interest rates, APR rates, additional charges, and repayment terms.

Credit-worthiness of borrower: An individual with a high credit score can easily qualify for low interest rates, while a poor credit score or existing debts spell "high-risk" to the lender, and hence may earn a high interest. The borrower’s financial status vis-a-vis the loan size matters too. High-income earners are generally considered safe borrowers and may qualify for lower rates.

Loan size and term length: Large and long-term loans tend to have high interests, especially since they’re typically compounded. For such loans, lenders may factor in possible future inflation, the risk of the borrower defaulting, and other variables and hence charge high rates.

Economic Climate and Policies

A flourishing economy means the demand for loans is high, as people spend and invest more. Lenders may hike interest rates during such times and lower them during low economic times.

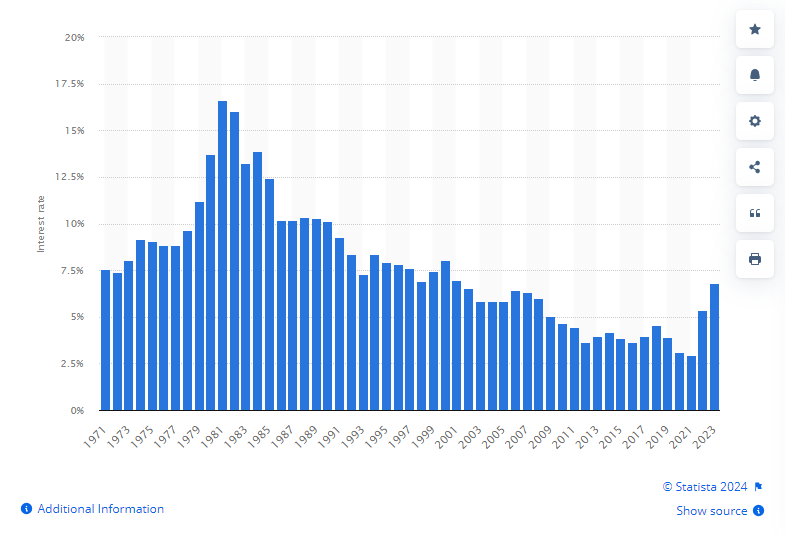

Inflation is another economic aspect that usually drives up interest rates. Inflation lowers the value of money. Lenders, therefore, keep up with inflation trends and adjust their interest rates accordingly to cushion themselves in the future.

A country's central bank regulates interest rates based on inflation, economic status, taxes, government policies, and other variables. Loan lenders and financial institutions respond to this by increasing or decreasing interest rates.

It's good to stay on top of these matters to know ideal borrowing or investment times and terms.

Conclusion

Interest rates can make or break your finances. By mastering interest types, loan factors, and economic factors that affect interest rates, you’ll be well on your way to better financial planning and decision-making. This knowledge will empower you to borrow responsibly to avoid debt traps or losses and also help you secure your financial future through brilliant saving and investing.